Climate Risk Management powered by weather data

October 15, 2024

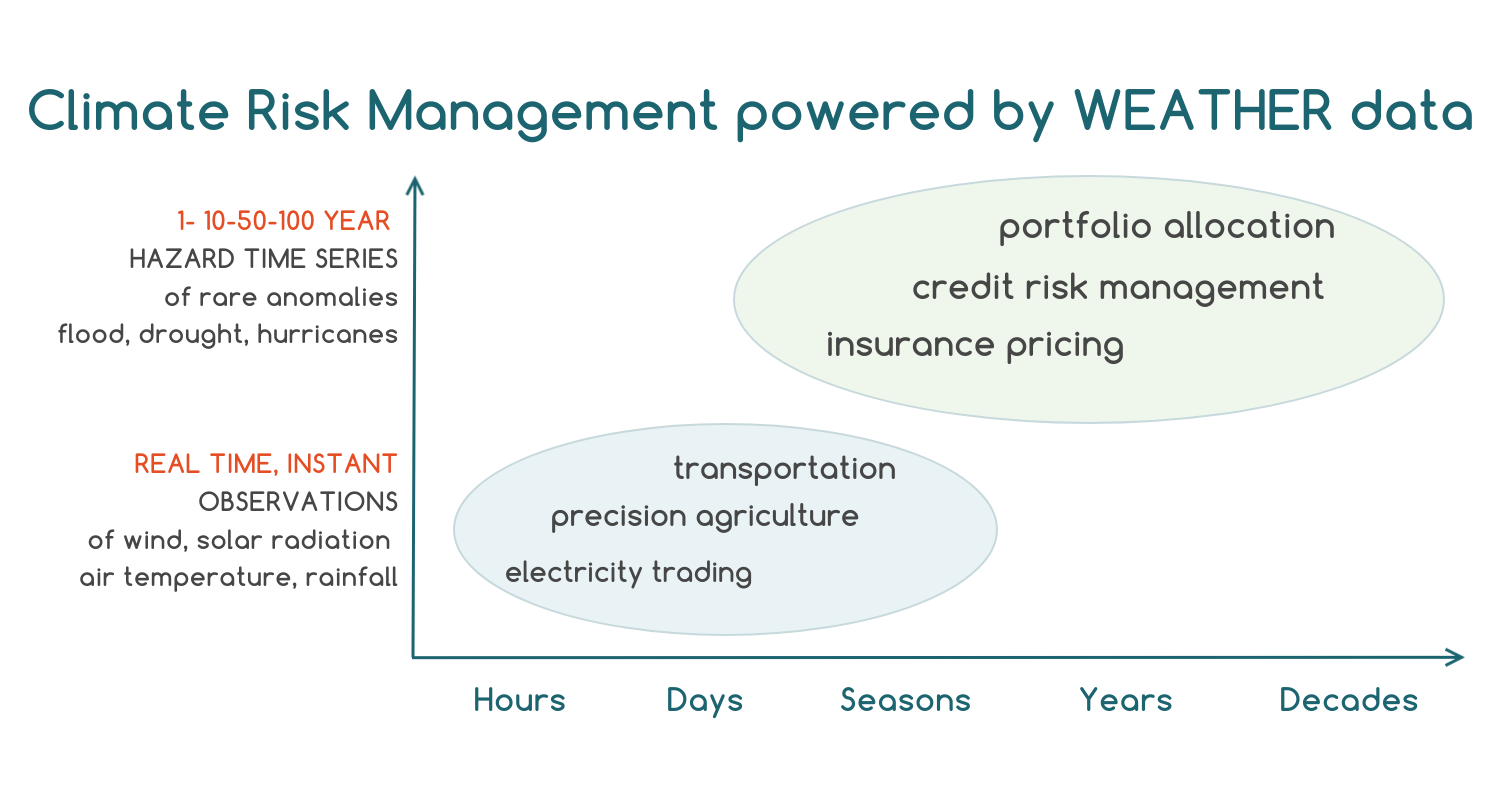

Why using different types of weather data for different use cases? What data do I need for effectively managing real-time disruptions in the supply chain? What data is best fit for long-term risk hedging, years and decades ahead? If you vary just one dimension, the time horizon of the data product, which risk management questions are covered?

A few examples cited here include the nowcasting (real-time), the seasonal and the multi-year time scale.

Short-term weather predictions : "nowcasting"

Precision agriculture and wind power supply forecasts require super detailed real-time weather forecast data. Weather forecasts guide the irrigation, the timing of the construction works, and also support the real-time electricity trading. For these applications the weather data is updated every 5-to-15 minutes. The focus is typically on one single geography. The term "nowcasting" refers to this super high resolution detailed forecast for a very limited time window of less than one hour.

Seasonal climate predictions

The flood insurance pricing and agricultural commodity trading bet on seasonal time scales. Seasonal rainfall anomalies are then translated into corn yield volumes for each specific region. This is quite impressive how the seasonal forecasts for the agricultural commodities drive the global maritime transport logistics two months ahead!

Multi-year climate risk assessment

Credit risk evaluation and asset diversification within the portfolio require a strategic vision of climate risks over much longer horizons - over years and even over decades. Forward-looking climate risk modeling is the hardest piece.

Hydropower construction, adaptation to coastal inundation due to sea level rise, planning of water retention basins for wildfire and for drought mitigation - these are the massive projects requiring the collaboration between the governmental funds and the institutional investors.

Climate proofing and climate stress testing is also based on the same types of climate data.

To support these use cases with long Weather Trade Net aggregates the best scientific data into business-level risk metric.

Risk scoring is the most user-friendly type of climate data. These aggregate anomalies into an index, classifying locations as either "at risk" or "safe." This simplification is advantageous for quick and efficient comparisons across regions, facilities, time horizons, and climate change scenarios.

Probability is linked to a particular critical threshold. Probability quantifies the likelihood of a specific extreme event, such as a flood reaching a one meter depth, or a drought exceeding a critical duration of one month.

Return Periods provide a measure of how frequently different extreme events are expected to recur. For example:

5 hurricanes in one season - happens once in ten years,

or

10 hurricanes - happens once in fifty years.

This technical risk metric is commonly used when designing infrastructure and long-term 5-20 year financial models.

Understanding these details is essential for leveraging the appropriate data types to their fullest potential in climate risk assessment.

The choice of data structure should align with the specific needs of the assessment, whether for quick decision-making or detailed impact modeling, to effectively manage climate risks.

Contact the Weather Trade Net team to see, what type of climate and weather data is the best fit for your use case!