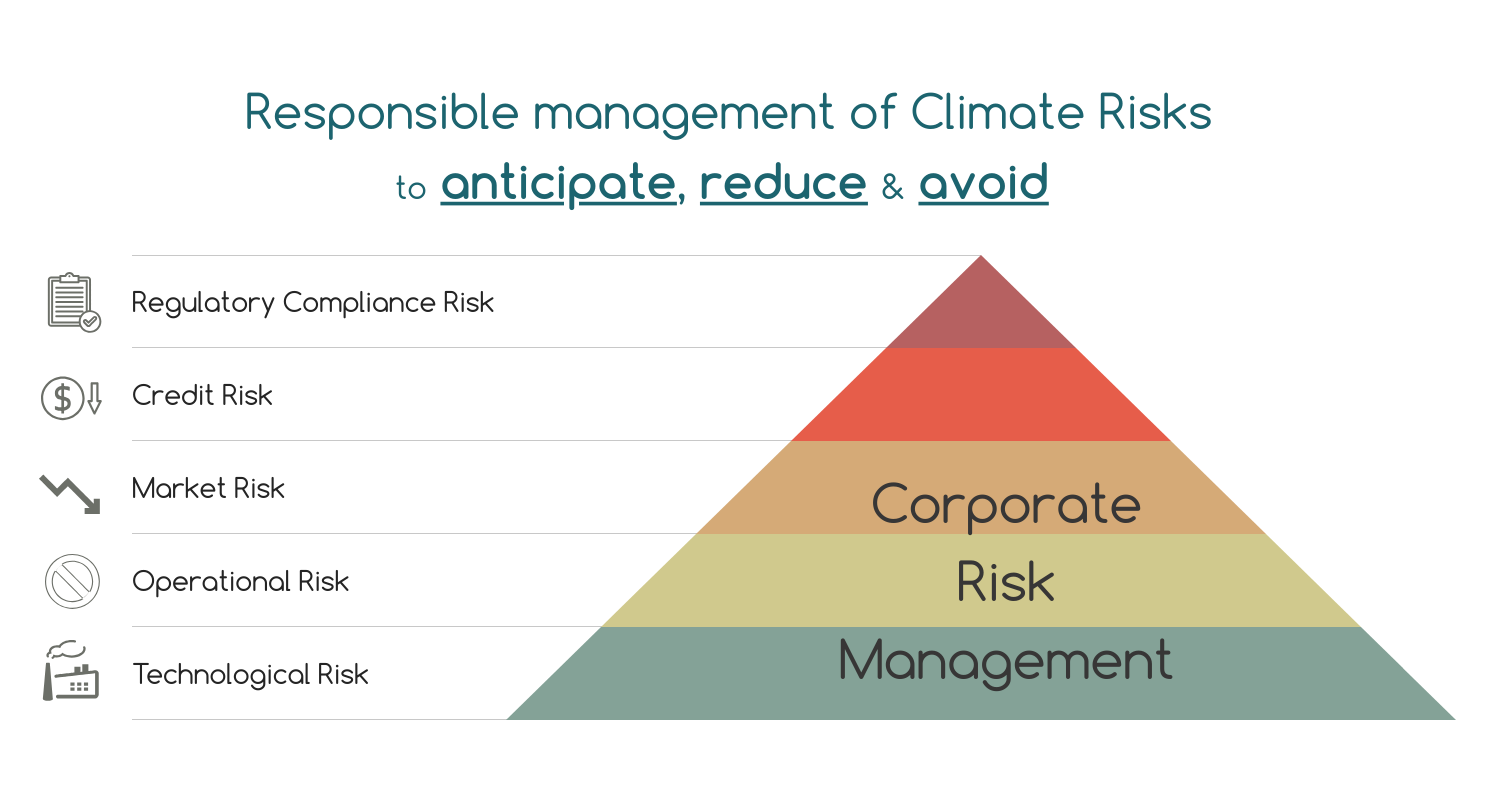

Corporate risk management of Climate Risks

August 15, 2023

When it comes to climate risk, it’s more about managing financial threats than ticking off a sustainability checklist. It's obvious, if a company is paying $1 M bill annually for flood insurance premium, it means (a) that the risk is high, and (b) that urgent mitigation action is needed to reduce financial loss and irreversible material damage.

Climate risk assessment isn’t about presenting colorful green-orange-red graphs in the corporate sustainability disclosures. It’s about addressing consequences of major floods and extreme droughts, and the resulting financial implications.

Physical climate risk exposure should be treated like any other business threat, fully integrated into a company’s overall risk management.

To support the financial risk assessment at Weather Trade Net we translate the frequency and the amplitude of anomalies into comprehensible business-level risk metrics. The meaning of the risk scores on a 1-to-5 scale is the following: no risk (1) - insurable (2,3,4) - uninsurable (risk score 5).

The risk scores are easy to use and very efficient for the initial screening and also for the optimisation of the impact assessment phaze. If there is no flood risk at 80% of your portfolio, then you don't need any risk management for these facilities. Optimisation is an essential part of the risk management!

Risk scores are unique to each geography and also hazard specific and period-scenario specific quantities. Scenario analysis makes sense when considered in the context of the historical reference. So the risk scores are evaluated for the historical period as well.

The risk scores are the indicators or signals for action.

If Low risk score: no need to zoom in, nothing urgent you should be aware off.

If Extreme or Severe risk score, then the TODO list might look as followed:

- check these properties and facilities in terms of these specific hazards,

- check your farm: do you have enough food, power and water capacity so that your animals survive if power shutdown,

- check the evacuation plan for your facility, if certain roads are flooded and if no electricity,

- check your electricity and water bills and subscriptions: do you pay tripple price during drought events?

- check your insurance contract formulations, with the focus on these specific hazards. Are you alone to rebuild everything? Does it cover 10% of material loss? Does it cover any business interruptions? Does it cover the additional multi-million electricity bill?

- and why not checking whether your emploees, their houses and schools are affected? How far do they live? Suppose there is nobody at work during one month, simply because the school is flooded.

Floods and droughts are unavoidable events. Risk scores for hazards is the groundtruth information to identify and quantify the potential impact. The goal is to make sure that there is minimum loss and damage. While the company won’t build any flood defences, yet, it is possible to protect the most expensive equipment. The machinery which is difficult to replace and to repair, can be located on elevanted levels within the factory. So even if there is a shutdown of the facility, the equipement is not damaged. The ready-to-sell production, for example, for a car manufacturer, also can be stored differently to make sure that new cars are not in the water. The damage is the worst when nothing is prepared in advance, and nothing planned. Last minute evacuation saves lives, but not the business.

The carbon footprint and green transition plan can’t be solved without any climate resilience roadmap.