Flood risk in context: regional estimates vs. property-specific

February 15, 2025

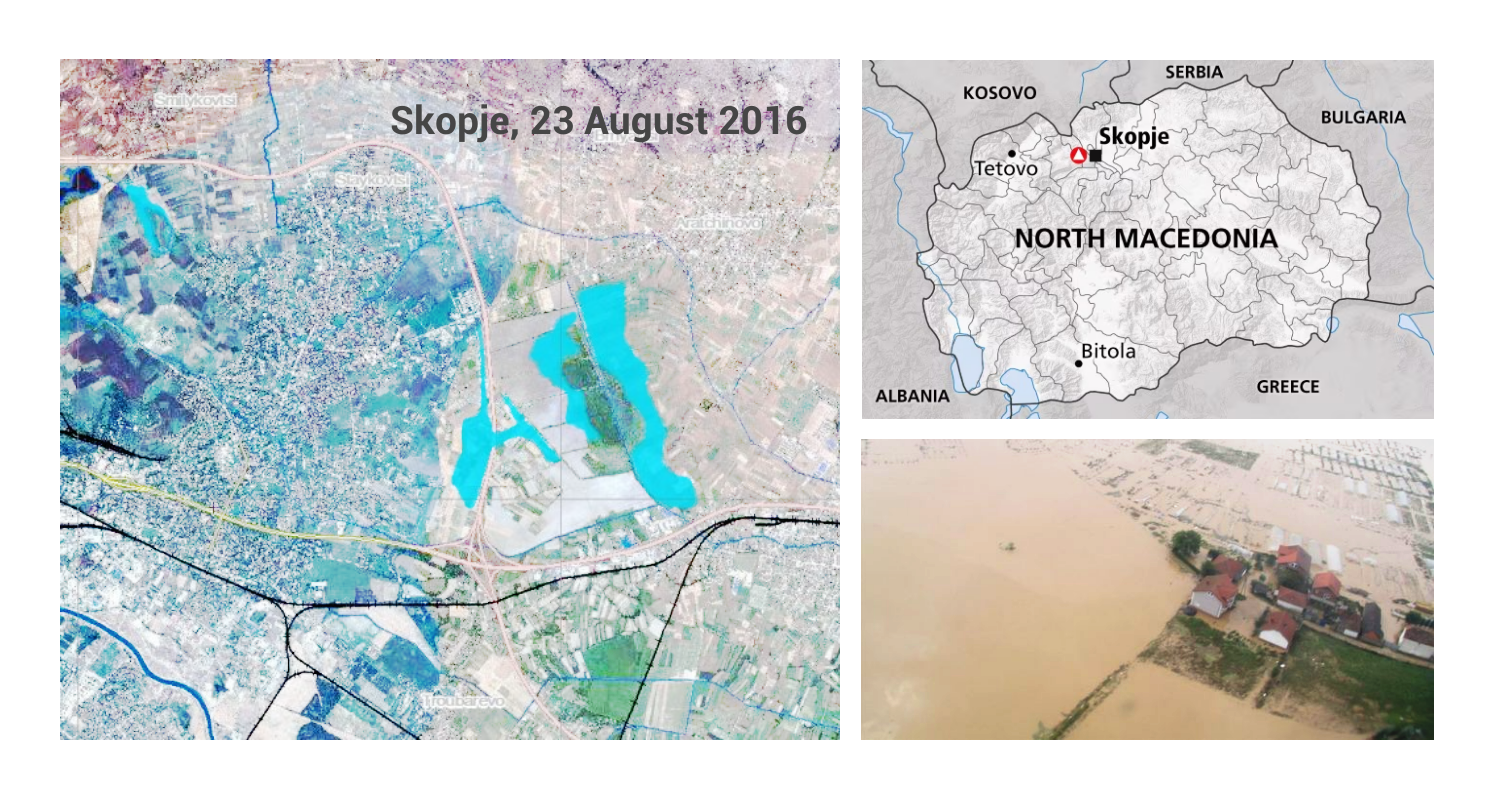

Recently, we had the opportunity to work with the European Investment Bank (EIB) and the Central Bank of North Macedonia. As a climate expert team, we delivered flood data at the province level, specifically:

- The fraction of the province flooded during a 100-year event, and

- The fraction of the province susceptible to flooding, regardless of a specific return period

To calculate this, we identified all 100-meter pixels with flood risk and summed their total area for each of 84 provinces.

Now the question we want to answer here: what are the potential use cases for such area-aggregated assessments? And who can benefit from this type of generic risk metric?

Let's suppose assets (properties) are evenly distributed across a province, for example, one per hectare. In this case, you can estimate flood risk for a given asset based on such aggregated province-level value.

For example, if 10% of the province is flooded during a 100-year event, then a random asset in that province has a 10% chance of being flooded over that return period. If you don't know the exact address, and you only know the province name and its flood-prone area fraction (e.g., 10%), this rough estimate can serve as a proxy for individual asset risk.

Use Cases

This type of aggregated metric is particularly relevant for:

-

Tourism, infrastructure (roads, railroads), and service industries that depend on labor availability, transport access and a "safety score";

-

Insurance companies frequently use such statistical estimates to price flat flood premiums: same fixed premium for all properties. This is also called "mutualisation".

However, for asset valuation, such as in real estate, and for M&A this type of province-wide statistic is not appropriate.

Alternative Methods for Property-Level Flood Risk

More precise approaches exist to assess flood risk for a specific property, factory, or land parcel.

Property-level flood risk assessment is the most accurate, but it requires the exact address or geolocation.

Multiple return period calculations can be performed on the county, province and municipality level. Instead of focusing on a single return period (once in 100 years), this method combines multiple probabilities, including rare, severe and catastrophic events, e.g., 200-, 300-, and 500-year floods.

Example:

10% flooded area / 100-year event → 1% annual probability

15% flooded area / 200-year event → 0.5% annual probability

20% flooded area / 300-year event → 0.33% annual probability

25% flooded area / 500-year event → 0.2% annual probability

Summing these annual probabilities, we get:

1% + 0.5% + 0.33% + 0.2% = 2.03%

This means for a specific property within the province there is a 2.03% probability per year of being affected by flood, directly or indirectly.

Direct impact refers to physical and material damage, while indirect impact includes financial loss and devaluation due to business interruptions.

However, this does not mean the event will happen exactly once every 49 years, it’s simply a statistical average. In reality, major floods may occur in two consecutive years or there could be long "normal" periods without significant floods.

The approach using multiple return period calculations provides an objective and fair measure of actual risk levels. So far, the interpretation of triple integrals, with multiple frequencies and the corresponding flood extents, and different flood depth ("nothing special" vs "catastrophic"), is the least obvious and intuitive, compared to other methods.

It’s important to note that banking authorities and insurance companies have established standardized benchmarks. For example, FEMA in the U.S. and the UK Environment Agency use the 100-year return period as the reference for subsidized flood insurance. The property is considered to be "at risk" if it is flooded more frequently than once in 100 years. In contrast, if it is flooded once in 101 - once in 200 / 500 years, then no subsidized flood insurance is proposed by FEMA and Flood Re.

To stabilize the residential property market and prevent stranded assets (when properties are uninsurable), governments subsidize flood insurance in certain flood areas, ensuring continued access to bank loans for homeowners in flood-prone areas. Commercial properties are excluded from the subsidized flood insurance scheme.

- Is my property located in a flood-prone area?

- What is the financial flood risk for my business activity?

- How likely 5% of assets (within the same portfolio) to experience flood in the same year?

Three questions: three different methodologies.

Not sure which methodology is best for your use case? Contact us, and our experts will guide you toward the most appropriate solution.