Physical climate risk for an equity portfolio

October 15, 2023

Investment in financial products qualify for responsible-&-ethical when fulfilling high environmental-&-social standards. Transactions are often backed by physical assets that can be directly exposed to floods and wildfires, such as real estate mortgages, transportation infrastructure and production facilities. Since the value of these underlying assets could be affected by climate perils, this should be reflected in the corporate, and also the equity portfolio physical climate risk rating.

Today the major rating agencies calculate the corporate physical climate risk scores using only the geolocations for the company's headquarters. These so-called "corporate" (headquarter) risk scores are further used to calculate the physical climate risk scores for equity portfolios.

For sure, the optimal solution can't be linear. To assess the corporate physical climate risk you need to consider: (a) location-specific flood risk for each facility and (b) the weight of each asset (facility) within the value chain.

Let's make an example, schematically.

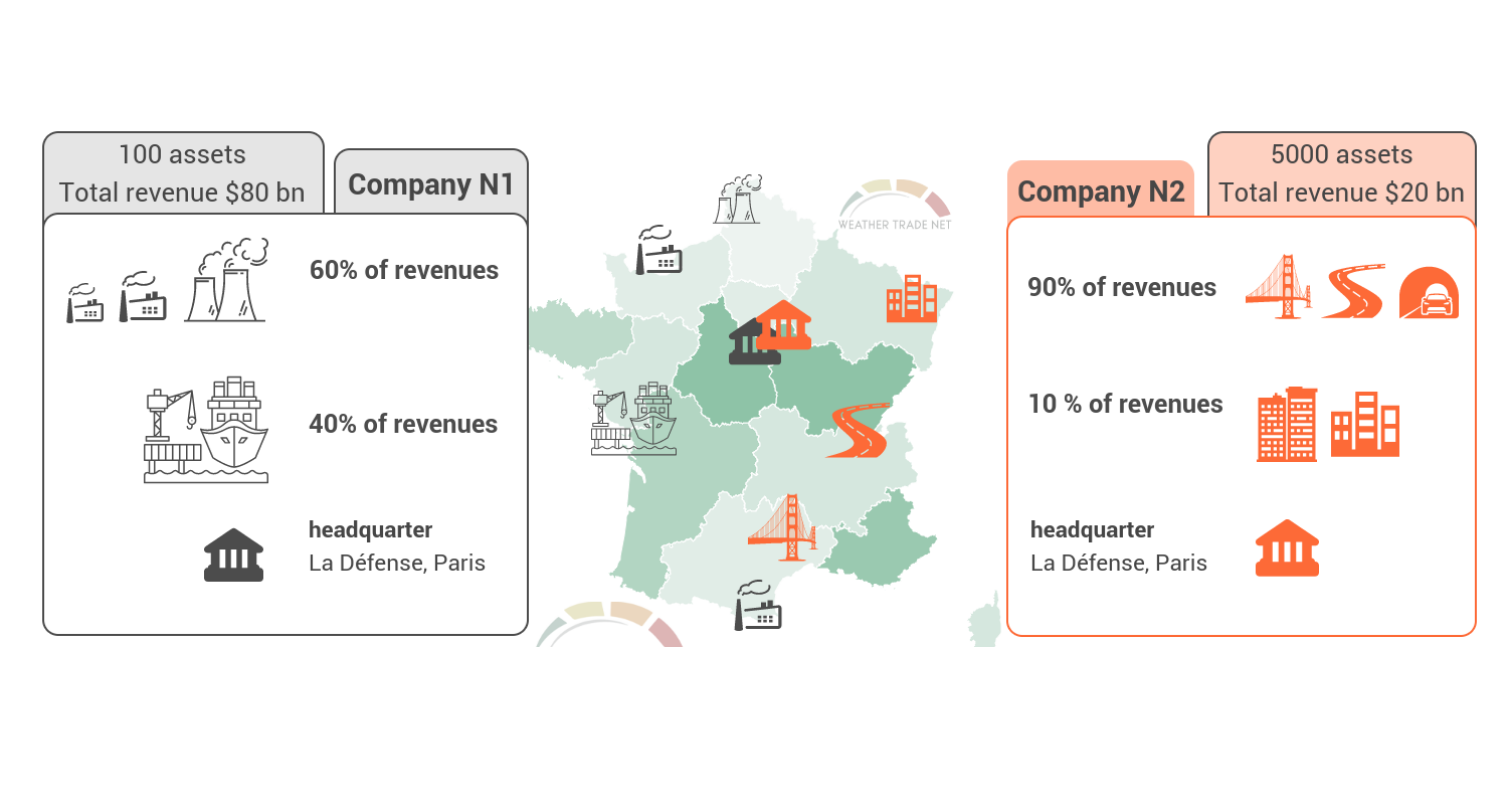

Suppose there are two companies registered with the same postal address. Headquarters of both companies are located on the same street. The flood risks are the same, and the wildfire risks are also the same between these two headquarters.

The first Company has 100 facilities and $80 bn revenue. The second: 5000 facilities and $20 bn revenue.

The first Company operates refineries near the coast line, with mineral ore and oil storage in ports, and also the offshore platforms worldwide (see map below). The second Company operates tunnels, highways and hundreds of parkings, inland, in one country.

Today, according to the rating data available on the market, the corporate physical climate risk score would be exactly the same for these two companies! Because the methodology considers only the headquarters and ignores all location-specific climate risks between facilities. Does it make sense? How this information and risk rating could guide the investment decisions?

Many companies know their physical climate risks and the actual financial losses. Here are a few numbers reported in the recently published Sustainability reports.

- Rebuilding one kilometer of the highway after a 2-day flood costs $2M.

- One week of water shortage costs $25M for the electronic chip manufacturer based in Taiwan.

- Loss of 100 containers in bad weather costs $5M for the shipping company.

With all the evidence, if insurance companies can price the flood risk, one could apply the same logic to the actual flood data to map Value-At-Risk across companies and the equity portfolios.