Where, What, When ?

October 15, 2023

Risk assessment consists of the identification of black swans: extremes, surprises and emerging tendencies. The focus of the physical climate risk assessment is on rare and exceptional floods, heatwaves and droughts.

The notion of risk is always beyond the average — everything outside of the normal, known, typical, and frequent.

Example: when the area is flooded every year, it's normal, it's not the risk. Instead, if there is a possibility of extreme flood over the next 10 years - this is the major risk! Probably you are not prepared, and there is a major risk for your property and your business.

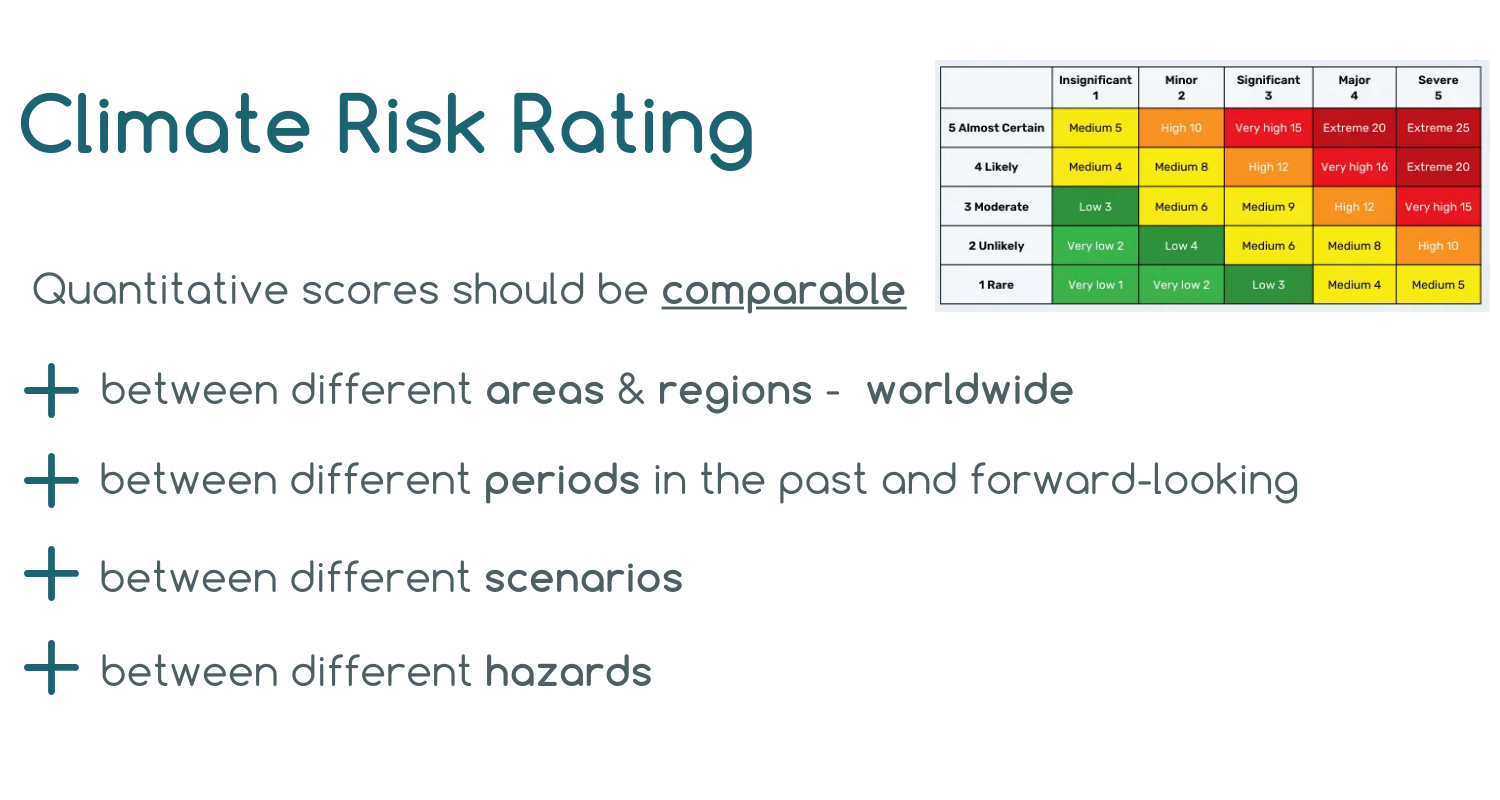

Climate risk rating should be comparable between geographic locations. Investors need standardized risk metrics.

OPEN DATA products can just tell you the daily or monthly average temperature, which is actually useless for investors and risk managers.

Instead, there is a need for quantitative climate risk metrics to set up timely prevention and anticipation of material and financial loss and damage.

The added value of WEATHER TRADE NET offer in the context of a multitude of climate data products is that we provide the complete and business-oriented physical climate risk analytics. Important difference: worldwide and instantly

At WEATHER TRADE NET we identify:

-

Which facility and physical asset has the highest risk?

-

What kind of risk is there? wildfire or extreme rainfall?

-

How urgent is the action?

And that’s not a trivial problem to solve!

For example, how do you compare the risk of heatwaves between Rome, Toronto and in Tokyo? The definition of extreme heat is not the same between these competely different regions. While 30-degrees temperature is rare in one locations, it is common for another location.

Risk rating also should allow the comparison the anomalies between hazards, for example, the number of hurricanes, the height of floodings, and the duration of droughts.

And the most basic part comes when comparing between different time horizons: “as of Today” versus the forward-looking periods.

First of all, each tendency should be regarded in the context of the historical reference. It is not enough to provide just the forward-looking risk score. The tendency should be considered in the context of something "well known". Something means the "risk", not the "average"!

For example, here we see that for the risk score for the HeatWave becomes CATASTROPHIC by 2050 for scenario ssp245. Actually it says that the portfolio-level HeatWave risk score is UNINSURABLE!

Next steps:

Proactive measures to reduce the loss and damage:

+ Store machinery and critical equipment on elevated levels

+ Install flood-resistant platforms

+ Implement rainwater harvesting systems on the roofs

+ Use flood doors

+ Set up drainage systems to divert water away from critical areas

Don’t wait for surprises, scan your climate risks today!